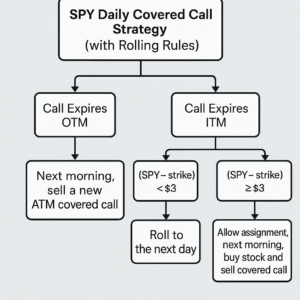

This page describes a simple, rules-based SPY covered call strategy that operates on a

daily cycle. The goal is to harvest option premium consistently, while using a clear decision process

for what to do when the covered call expires out-of-the-money (OTM) or

in-the-money (ITM).

Core Idea

You hold 100 shares of SPY and sell a daily (or very short-term) covered call

against those shares. At the end of each trading day, you evaluate the option at expiration and follow a

fixed set of rules:

- If the call expires OTM → keep shares and sell a new ATM call the next morning.

- If the call expires ITM but only slightly (intrinsic value < $3) → roll to the next day.

- If the call expires ITM by $3 or more → allow assignment, then buy back SPY next morning and sell a new ATM call.

This structure turns SPY into a daily income engine while keeping the rules mechanical

and easy to follow.

Step 1: Initial Setup

- Buy 100 shares of SPY.

- Sell 1 ATM covered call on SPY that expires the same day (or the nearest available daily expiration).

- Hold the position until the option expires at the end of the session.

From here, your day-to-day logic is completely determined by how that call finishes at expiration.

End-of-Day Decision Rules

At expiration, compare the closing price of SPY to your call strike:

| Condition at Expiration | Action | Comment |

|---|---|---|

| Call expires OTM (SPY close ≤ strike) | Next morning: sell a new ATM covered call | You keep the shares and keep 100% of the premium. |

| Call expires ITM and (SPY close − strike) < $3 | Roll the call to the next day | Take assignment risk off by rolling; treat this as “small ITM, keep the position alive.” |

| Call expires ITM and (SPY close − strike) ≥ $3 | Allow shares to be called away. Next morning, buy 100 shares of SPY again and sell a new ATM call. | Lock in the gain on SPY (≥ $3 ITM) plus premium, then immediately re-establish the covered call. |

Rule Logic in Plain English

1. OTM at Expiration: Premium Harvest Mode

If SPY closes at or below your strike:

- The option expires worthless.

- You keep all the call premium as profit.

- You still own your 100 SPY shares.

- Next morning: sell a fresh ATM covered call again.

This is the ideal scenario: you collected income and kept the stock. The strategy simply repeats.

2. Slightly ITM (< $3 Intrinsic): Rolling Mode

If SPY closes above the strike, but the difference is smaller than $3:

- SPY close – strike < $3 (for example, strike 500, SPY close 501.50).

- Intrinsic value is small; you don’t want to lose the shares cheaply.

- Action: roll the covered call to the next day (same or adjusted strike, new expiration).

Rolling allows you to:

- Maintain your long SPY position.

- Collect additional premium on the new call.

- Smooth out small ITM moves without constantly having shares called away.

3. Deep Enough ITM (≥ $3 Intrinsic): Realize Profit & Reset

If SPY closes at least $3 above your strike:

- SPY close – strike ≥ $3 (for example, strike 500, SPY close 504).

- You’ve captured a meaningful move in SPY plus the original call premium.

- Action: let the shares be called away (assignment is fine).

Then, on the next morning:

- Buy 100 shares of SPY again at the new price.

- Sell a new ATM covered call expiring that same day.

This locks in a larger realized profit when SPY makes a strong move, then immediately restarts the

income engine at the new price level.

Daily Routine Summary

- Morning: own 100 SPY, sell 1 ATM call expiring today.

- Close: check where SPY finishes relative to the strike:

- OTM → do nothing overnight; next morning, sell new ATM call.

- ITM, < $3 intrinsic → roll the call to the next day.

- ITM, ≥ $3 intrinsic → allow assignment; next morning, rebuy SPY and sell new ATM call.

Risk Management Notes

- This is still an equity strategy; you carry SPY price risk.

- The call premium helps cushion small drops but does not fully protect against large selloffs.

- You can reduce risk by:

- Keeping position size appropriate for your account.

- Avoiding selling calls through major events (CPI, FOMC) if desired.

- Optionally turning the call into a call spread to cap risk.

Who This Strategy Is For

- Traders comfortable holding SPY as a core position.

- Covered-call investors who want a daily, rules-based framework.

- People who prefer clear “if–then” rules instead of discretionary decisions.

By following the rolling logic consistently—OTM → new ATM call, small ITM → roll, large ITM →

realize profit and reset—you turn SPY into a disciplined daily income strategy.