A rules-based, positive-theta framework for harvesting intraday option premium while keeping market exposure tightly controlled.

Strategy Overview

The delta-neutral 0DTE strategy is designed to generate intraday option income by selling premium on

zero-days-to-expiration (0DTE) index options while maintaining a tightly controlled delta band.

The primary goal is to profit from time decay (theta) and the typical overpricing of implied volatility,

rather than from predicting market direction.

All positions are opened and closed within the same trading day. No overnight risk is taken.

Key Principles

- Delta-neutral bias: Keep portfolio delta in a narrow band, e.g. about −0.2% to +0.2% SPY-adjusted delta.

- Positive theta: Use credit spreads and defined-risk structures so time decay works in your favor.

- Defined risk: Avoid naked short options; cap tail risk using spreads and wings.

- Intraday only: Open after the market stabilizes, close before or at the end of the session.

- Rules-based adjustments: Adjust delta systematically using small option spreads, not emotional discretion.

Core Trade Structures

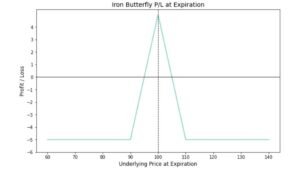

1. ATM Iron Butterfly (Core Position)

The iron butterfly is the primary structure used to collect intraday theta on 0DTE index options (such as SPX):

- Sell 1 ATM call

- Sell 1 ATM put

- Buy 1 OTM call (upper wing)

- Buy 1 OTM put (lower wing)

This creates a defined-risk, short-volatility position centered around the current price. It starts with

near-zero delta and high positive theta, making it ideal as a base for a delta-neutral income strategy.

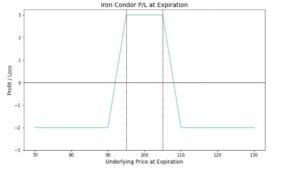

2. Iron Condor (Alternative / Complement)

A symmetric iron condor can be used instead of, or in addition to, the iron butterfly:

- Sell an OTM call spread above the market

- Sell an OTM put spread below the market

While the theta is typically lower than an iron butterfly, the risk profile can be more forgiving on large intraday moves.

Delta Control Using Credit Spreads

To keep the portfolio within the target delta band (about −0.2% to +0.2% SPY-adjusted delta), the strategy uses small SPX credit spreads:

Bear Call Spread (BCS)

- Construction: Short a call, long a higher-strike call (same expiration).

- Profile: Credit spread, negative delta, positive theta, defined risk.

- Use when: Portfolio delta is too positive and needs to be nudged back toward zero.

Bull Put Spread (BPS)

- Construction: Short a put, long a lower-strike put (same expiration).

- Profile: Credit spread, positive delta, positive theta, defined risk.

- Use when: Portfolio delta is too negative and needs to be brought back toward neutral.

Both BCS and BPS are credit spreads with positive theta. This is a key design choice: even the delta

adjustments are intended to contribute to income rather than act as pure cost centers.

| Condition | Action | Effect on Delta | Theta |

|---|---|---|---|

| Delta above upper band (too bullish) | Add small bear call spread(s) | Delta shifts downward | Positive |

| Delta below lower band (too bearish) | Add small bull put spread(s) | Delta shifts upward | Positive |

Risk Management Rules

Delta-neutral does not mean risk-free. The strategy relies on strict, pre-defined risk controls:

- Daily loss limit: A maximum daily loss (in % or $) after which all positions are closed and trading stops for the day.

- Per-trade stop: Each iron fly / condor has a maximum loss threshold (for example, 1–2x credit received).

- Event filter: Avoid or reduce size around major economic releases (FOMC, CPI, NFP) where intraday volatility can be extreme.

- Position sizing: Use a small, consistent fraction of account equity per day to reduce the impact of any single session.

Daily Trading Workflow

- Pre-market: Review economic calendar, volatility environment (e.g. VIX), and overnight news.

- After open: Wait for the first part of the session to stabilize before entering new 0DTE positions.

- Entry: Sell one or more defined-risk iron butterflies or iron condors on the index, centered near current price.

- Monitor & adjust: Track portfolio delta; if it leaves the target band, add small bear call or bull put spreads to bring delta back toward neutral.

- Manage risk: Reduce or close positions if daily or per-trade loss limits are hit.

- Exit: Close all open positions before the designated cutoff time. No overnight positions are carried.

- Review: Log trades, P&L, and any deviations from the rules to refine execution over time.

Who This Strategy Is For

This delta-neutral 0DTE framework is aimed at traders and investors who:

- Prefer rule-based, systematic approaches over discretionary guessing.

- Want to harvest intraday option premium with defined risk.

- Are comfortable monitoring markets during the trading day.

- Understand that even delta-neutral strategies can experience drawdowns and tail-risk events.

Important Disclaimer

The information on this page is for educational purposes only and does not constitute financial, investment,

or trading advice. Options trading involves substantial risk and is not suitable for every investor. Always perform your own

due diligence and consult with a licensed financial professional before implementing any strategy.